The Autumn Budget 2015 brought with it another change to the tax payable on property purchases. This time George Osbourne revealed his proposals to increase the Stamp Duty Land Tax (SDLT) paid on the purchase of second properties in an attempt to assist first time buyers in an increasingly expensive housing market.

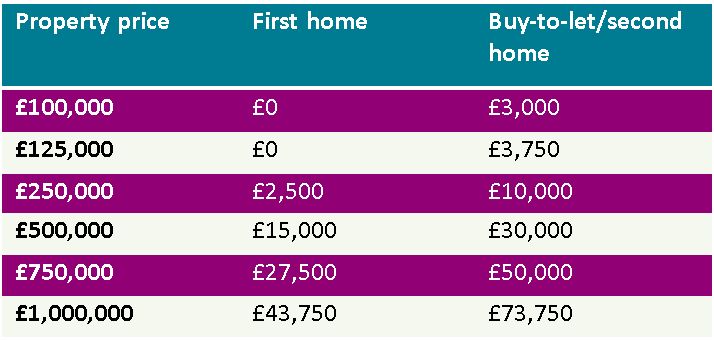

The announcement that a 3% surcharge in SDLT will be charged on the purchase of additional residential properties priced at £40,000 and above from 1 April 2016 has not been welcomed by all.

The Council of Mortgage Lenders has warned of unintended consequences with the possibility of buy-to-let landlords offsetting the increased cost with higher rental charges, a particular concern in urban areas. The delay in implementing the surcharge also has raised fears of a rush to purchase investment properties leading to an overall rise in house prices.

Trustees have the right to feel particularly hard done by with the inclusion of proposals to apply the charge to some trust arrangements, even when the trustee will never occupy a property purchased in the name of a trust. Beneficiaries could also fall foul of the surcharge being applied to their personal property acquisitions.

The increased SDLT rate will also apply to couples and joint purchasers where one of them already owns a residential property. Even if the intention is to sell their existing property the surcharge will apply to second purchase.

However, a refund will be available if the existing property is sold within 18 months of the purchase of the new main residence. Despite the availability of a refund the critics have pointed to the unnecessary strain caused to some genuine purchasers who will have to front up the surcharge cost.

Relief for investors

There is, however, some respite for those seeking to put money into the property market. Properties formed of residential and commercial parts, such a shops or pubs with flats above, will not be subject to the surcharge. They will instead be treated as non-residential purchases, even if the properties are later converted to wholly residential properties.

Investors purchasing six or more residential properties in linked transactions will still be able to utilise the multiple dwelling relief. That is they will now be able to choose the slightly lower commercial SDLT rates. This will be of little relief to smaller investors seeking to supplement their pension.

Developers will be particularly relieved to find that they will not be subject to the surcharge on the purchase of bare land, which will still attract the commercial rates. Care should be taken when purchasing garden plots adjoining residential properties as this will be subject to the surcharge.

Consultation on the Supplemental Stamp Duty Land Tax

Interested parties should prepare themselves for changes to the proposals, with the draft legislation due to be published following the publication of the UK budget in mid-March. However, following the consultation process many note the only area subject to any change is that of large-scale property investors with portfolios of 15 or more properties.

With the implementation of the surcharge looming buy-to-let landlords, investors, holiday home owners and even those who own property in foreign countries should prepare themselves for the increased rate.

Should you require more advice please contact Anna Duffy, Head of Commercial Property in our Commercial Property team on 01244 354800 or anna.duffy@dtmlegal.com