As a business owner, you may already be aware that you will have to pay a levy from the 6th April 2017, but have you considered how exactly it will affect your business?

Whilst there are still some unknowns about how the Apprenticeship Levy will work, DTM Legal explains what you and your business should know so far.

What is the Apprenticeship Levy?

The Government is changing the way they fund apprenticeships by asking employers operating in the UK with a pay bill in excess of £3 million per annum to make contributions. Once an organisation hits the threshold, they will be required to start making payments based on 0.5% of their annual pay bill.

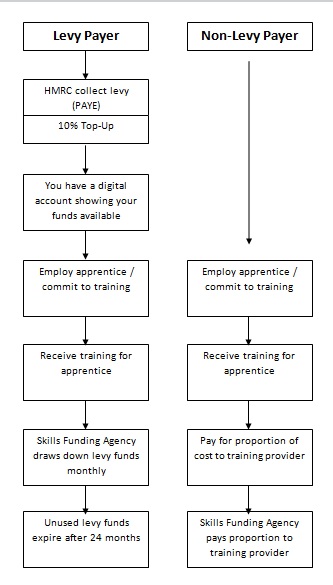

Once an employer has started making contributions, they will be able to access the funds for apprenticeships through their digital apprenticeship service account, an online tool which will be made available to employers. This means that they can use contributions they have made to pay for apprenticeship training. In addition, HMRC will provide a 10% top up on employer contributions – so for every £1 that an employer puts into their account, the Government will provide an additional 10 pence.

The Facts

- The levy will be introduced on the 6th April 2017

- Any employer, in any sector with a payroll bill of more than £3 million per year, and operating in the UK, is liable to pay the levy

- Employers will have an Apprenticeship Levy allowance of £15,000.00 per annum (connected companies or charities will only have one £15,000.00 allowance to share between them)

- It will be a set rate of 0.5% of your total payroll (see HMRC basic payee tools to work out how much you’re meant to pay)

- Employers will receive a 10% top up to their digital account i.e. every £1 will be increased to £1.10 in value

- It will be collected on a monthly basis based on ‘live’ HMRC payroll data

- Report your Apprenticeship Levy each month using your Employment Payment Summary (EPS)

How will the Apprenticeship Levy work?

What happens next for employers?

Once you have registered and paid the levy, your company will then be able to access funding through a digital apprenticeship service account. This will allow you to select and pay Government-approved training providers and post apprenticeship vacancies.

Initially, the service will only be available to businesses paying the levy, but the plan is to give all employers access to the digital account by 2020. It is worth noting that the digital apprenticeship service will only apply to businesses in England. Separate measures will be in place for Scotland, Wales and Northern Ireland.

What does ‘Government-approved training provider’ mean?

The Government has opened a new register of apprenticeship training providers. These providers will have to pass quality and financial tests, while those with an ‘inadequate’ Ofsted rating will not feature on the register.

If you require assistance when calculating your annual levy payment or you want to discuss how best your business can prepare for the Apprenticeship Levy, please contact Employment Associate, Tom Evans, on 0151 321 0000 or e-mail tom.evans@dtmlegal.com.