The new Part 21A of the Companies Act 2006 requires all UK limited companies and limited liability partnerships (LLPs) to keep a register of people with significant control (a “PSC”) in their company. You can refresh your memory on the background to the changes and the information which will be made public by reading our previous blogs here and here. In this update, we provide an overview of what practical steps you should be taking, if you are not already, in order to comply with the new law.

From 30 June 2016 onwards, UK limited companies and LLPs will be required to file a confirmation statement (in place of its annual return) and disclose its PSC register. Failure to do so is an offence for which the company could be liable to an unlimited fine and its directors could be liable to an unlimited fine and/or imprisonment.

Take Steps to identify PSCs

Companies should be taking steps to identify all potential PSC’s, namely anyone who:

- legally or beneficially owns more than 25% of the company’s shares or voting rights;

- has the right to appoint or remove a majority of the board of directors;

- has significant influence or control over the company;

- has significant influence or control over a trust or firm (in the case of shares held by trustees or a trust or by members of a partnership).

Once potential PSC’s are identified reasonable steps should be taken to confirm that the information is correct. Companies House has published guidance on what amounts to “reasonable steps” and this includes (but is not limited to) reviewing the company’s register of members, articles of association, statement of capital, shareholder agreements, voting patterns (to see if some parties are acting together) and agreements concerning removal of majority of votes at board level.

A thorough investigation is essential and should be properly documented. It may be that, having taken these steps, a company cannot identify the person or confirm their details, but failure to take reasonable steps is a criminal offence.

Keep an Internal PSC Register

UK limited companies and LLPs should already be maintaining an internal PSC register as this became mandatory on 6 April 2016. The register should not be left blank even if the PSCs are not yet known and should instead read:

“The company has not yet completed taking reasonable steps to find out if there is anyone who is a registrable person or a registrable relevant legal entity in relation to the company.”

Provide a Confirmation Statement to Companies House

From 30 June 2016 UK limited companies and LLPs will no longer be required to file an annual return. Instead, they must file a confirmation statement which is intended to be a simplified process and should make administrative life easier.

Instead of repeating previously filed information as is the case with the current annual return, companies and LLPs need only ‘check and confirm’ the corporate details held at Companies House and displayed on public record. Any relevant changes can be provided on the confirmation statement. There will be no need to submit a list of shareholders or statement of capital, unless changes need to be reported.

All UK limited companies and LLPs incorporated after 30 June 2016 will need to complete a statement of initial control containing PSC information. For companies incorporated before 30 June 2016, the PSC register will need to be filed with Companies House when the first confirmation statement becomes due.

Monitor and maintain the PSC register

The information on the company’s internal PSC register must be kept up-to-date and a failure to do so may amount to a criminal offence. There is no requirement to notify Companies House of the changes as and when they occur, however the register will need to be updated when filing the next confirmation statement.

Registrable Relevant Legal Entities

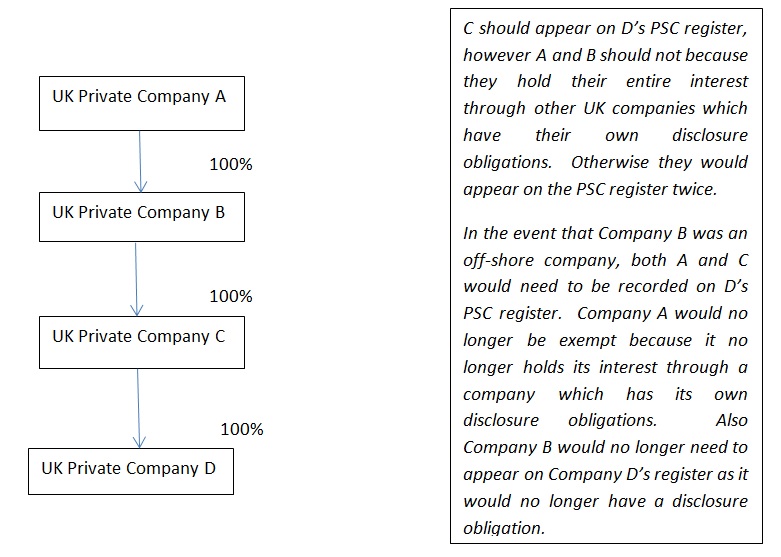

It is not just individuals or ‘persons’ as the name misleadingly suggests, that may need to be listed on the PSC register. In a chain of legal entities, the PSC register will need to identify any UK company or LLP, or non-UK Company with voting shares listed on certain markets (i.e. an entity that is subject to its own disclosure requirements), that would have been a PSC if it were an individual. This is to ensure that the ultimate owners of the company are identifiable from the PSC register.

There is however an exception and legal entities do not need to be recorded on the register if they hold their interest only via other entities each of which are subject to their own disclosure requirements. For example if X is owned by Y and Z is a PSC for Y, Z will not be required to be on X’s PSC register because they can be identified by Y’s PSC register. This is intended to prevent duplication.

What about off-shore entities?

Non-UK legal entities that hold interests in UK companies will not themselves be recorded on the PSC register (except for non-UK entities with voting shares listed on certain markets). However, those holding interests indirectly through such Non-UK legal entities may need to be registered.

A person is treated as having an indirect interest if it has a ‘majority stake’ in a legal entity that holds the share through a chain of legal entities each of which (other than the last) has a majority stake in the entity below it and the last of which holds the share or right in the UK company.

Illustration of Registerable Relevant Legal Entity

Whilst the changes are intended to simplify company administration, the task of maintaining a PSC register will no doubt increase the burden placed on companies. Even for small businesses where PSCs are easily identifiable, it is important to have someone appointed and a compliance process in place to maintain and review the register. Failure to do so could have far reaching consequences for the company and its directors.

If you have any queries about the new PSC regime or help with any other corporate or company secretarial matters, please contact Edward Barnes on 0151 321000 or at edward.barnes@dtmlegal.com.