The budget has produced a number of changes impacting on the property market. Whilst we are still digesting the full extent of what lies ahead, the follow points provide a quick snap shot of information that it is key to know sooner rather than later.

Commercial Stamp Duty Land Tax rates

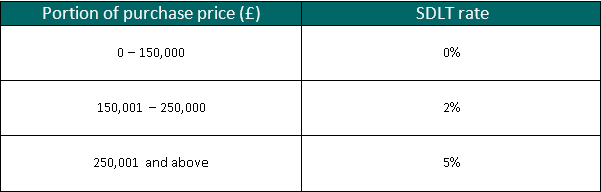

Effective from midnight 16th March 2016, the new commercial Stamp Duty Land Tax rates are as follows:

The rates will be calculated in relation to each portion of the purchase price as opposed to the previous ‘slab’ system.

There will also be a new 2% rate for high value leases with a net present value above £5m.

SDLT Surcharge on Second Homes

As previously advised in our blog about Supplemental Stamp Duty Land Tax, it has been announced that a 3% surcharge will be applied to purchases of second homes.

We have also seen confirmation that there will be no exemption for large scale investors (15 plus properties) and that purchasers will have 36 months rather than 18 months to claim a refund of the higher rates, if they buy a new main residence before disposing of their previous main residence.

For a more detailed account of what was detailed in the Budget, please visit the GOV.UK site.

If you would like any advice on how the property related updates in the budget may have an impact on you or your business, please contact Michael Wright on 01244 354804 or michael.wright@dtmlegal.com.