The Pension Advisory Group have just published a second edition of their Guide to the Treatment of Pensions on Divorce, known colloquially as ‘PAG2’. Helen Davies explains PAG2 and Pension Sharing in divorce.

The first edition was published in July 2019 and was welcome guidance in this complex area of law. The guide was adopted by the Financial Remedies Courts Good Practice Protocol but was still not without its critics and there continued to be debate as to the correct legal approach to the sharing of pensions.

For many “normal” separating couples i.e. not those cases where “big money” is involved, the proper valuation and understanding of the differing nature of pensions is key to ensuring fairness, particularly in a case where the main assets are a house and a pension.

Most people focus on what will happen to the family home but often pensions are a huge asset with values greater than that of the family home and they are particularly important when planning your future. Arguably, this appears to be hitting divorcing women hardest.

Scottish Widows recently published their annual Women and Retirement Report. This followed only shortly after the research published by the University of Bristol in November titled “Fair Shares? Sorting out money and property on divorce”.

Of over 120,000 divorces granted in the UK in 2021, the Scottish Widows research found that during this time, at least 60% of the women involved in those divorces did not discuss pension assets, most commonly because they did not know they should. This report also highlighted that divorced women are substantially less likely to be on track for better retirement lifestyles with 60% of divorced women not even on track for a minimum lifestyle.

The Fair Shares report again highlighted that there was a lack of awareness, understanding and interest in pensions amongst many divorcing couples which also fed into how they were being dealt with when negotiating financial settlement. This is despite pension assets quite often being one of the most significant assets within a marriage. It seems that there is still much work to be done in this area.

It is hoped that the updated guidance will provide a further tool for when thorny pension issues arise.

The division of pension assets explained

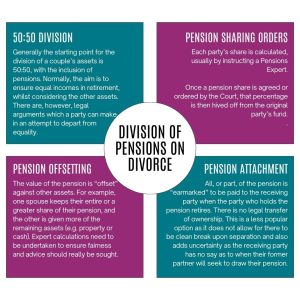

Pension assets are dealt with on a case-by-case basis but generally the starting point for the division of a couple’s assets is 50:50, with the inclusion of pensions. Normally, the aim is to ensure equal incomes in retirement, whilst considering the other assets. There are, however, legal arguments which a party can make in an attempt to depart from equality such as, the length of marriage, whether assets were accrued pre or post marital and on the basis of need.

However, as highlighted, each case is fact specific, and it is key to take legal advice to determine the most appropriate approach to take.

Pension Sharing Orders

There are several ways pensions can be dealt with on divorce, but this most commonly comes in the shape of a Pension Sharing Order. During negotiations, each party’s share is calculated, usually by instructing a Pensions Expert, who considers age, income to be generated and any other pension assets when preparing their report.

Once a pension share is agreed or ordered by the Court, that percentage is then hived off from the original party’s fund and the receiving party can become a member of the pension scheme or transfer the value to a new pension provider.

This is the preferred option for many people as it provides for a clean break between the parties. Once pensions are divided up or a new pension is created for the receiving spouse, there’s no need to worry about it again.

Pension sharing is an option only available on divorce or the dissolution of a civil partnership. Unmarried couples are not entitled to a pension sharing order.

What happens once I have a Pension Sharing Order?

A Pension Sharing Order can only be made by the Family Court (whether it is ordered by consent or on conclusion of financial proceedings) and the amount to be transferred is detailed as a percentage of the value of the pension pot.

Whether the receiving party decides they want to remain a member of the existing scheme or transfer their share into a new fund, after the sharing order comes into effect, the receiving party owns the pension in their own right and can manage it how they see fit.

A pension provider can only implement the order once they are in receipt of all final documents. Therefore, when contacting a pension provider to request the implementation, the following documentation should be provided: –

- A copy of the sealed financial order and pension sharing annex (setting out details of the pension share to be implemented);

- A copy of the decree absolute (if the divorce petition was issued before 6 April 2022) or final order (if the divorce application was issued after 6 April 2022);

- Payment for any pension sharing charges if applicable however, the pension provider will be able to provide confirmation as to any additional costs.

Once the above documentation has been served on the pension provider, a pension provider has up to 4 months to complete the implementation.

Other options to Pension Sharing Orders

Whilst Pension Sharing is most common at present and arguably preferred by the Courts to ensure a couple’s needs are considered both now and into retirement, there are other options. These include:

Whilst Pension Sharing is most common at present and arguably preferred by the Courts to ensure a couple’s needs are considered both now and into retirement, there are other options. These include:

Pension Offsetting: The value of the pension is “offset” against other assets. For example, one spouse keeps their entire or a greater share of their pension, and the other is given more of the remaining assets (e.g. property or cash). Pensions and other assets cannot be considered equal on a pound for pound basis due to the differing nature of the two classes of assets. As such, expert calculations need to be undertaken to ensure fairness and advice should really be sought.

Pension Attachment/Earmarking: All, or part, of the pension is “earmarked” to be paid to the receiving party when the party who holds the pension retires. There is no legal transfer of ownership. This is a less popular option as it does not allow for there to be clean break upon separation and also adds uncertainty as the receiving party has no say as to when their former partner will retire and seek to draw their pension.

Speak to a Divorce and Dissolution Solicitor

If you require advice in relation to separation and the division of matrimonial assets, DTM Legal has Family Law, Divorce, and Dissolution lawyers in our Chester and Liverpool offices who are here to help. Please contact our expert team who can advise you as to your options on 01244 568635 or 0151 3210000 or email helen.davies@dtmlegal.com.